The Three Factors Affecting Home Affordability Today

Buying

Buying

There’s been a lot of focus on higher mortgage rates and how they’re creating affordability challenges for today’s homebuyers. It’s true that rates climbed dramatically since the record-low we saw during the pandemic. But home affordability is based on more than just mortgage rates – it’s determined by a combination of mortgage rates, home prices, and wages.

Considering how each one of these factors is changing gives you the full picture of home affordability today. Here’s the latest.

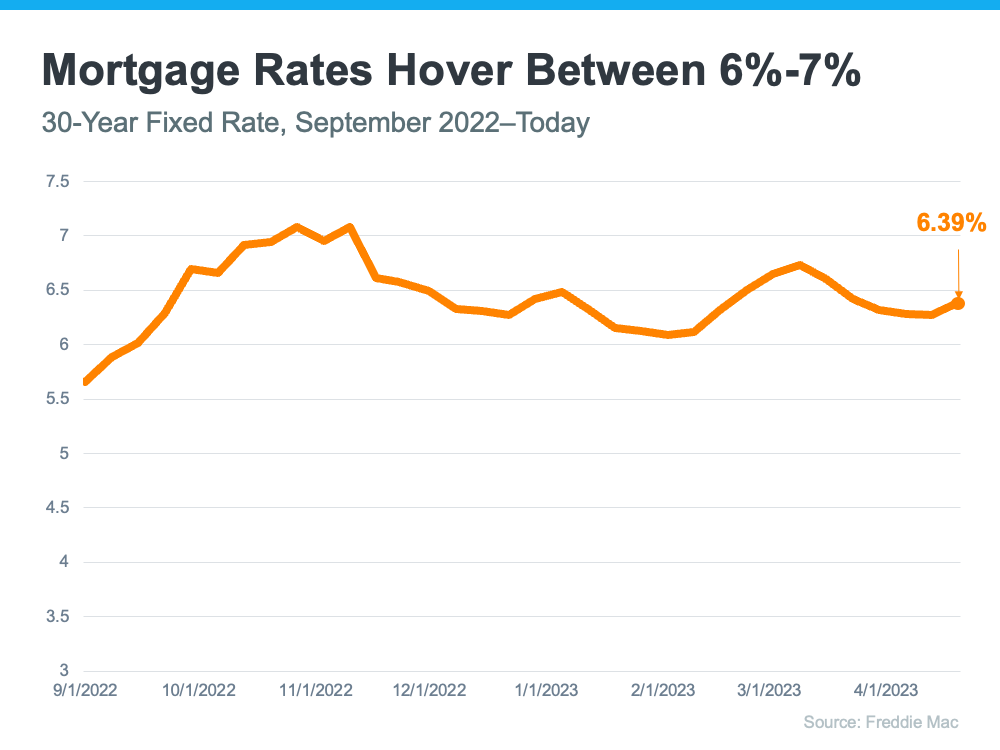

While mortgage rates are higher than they were a year ago, they’ve hovered primarily between 6% and 7% for nearly eight months now (see graph below):

As the graph shows, mortgage rates have experienced some volatility during that time. And even a small change in mortgage rates impacts your purchasing power. That’s why it’s so important to lean on your team of real estate professionals for expert advice to stay up to date on what’s happening in the market. While it’s hard to project where mortgage rates will go from here, many experts agree they’ll likely continue to remain around 6%-7% in the immediate future.

Over the past few years, home prices appreciated rapidly as the record-low mortgage rates we saw during the pandemic led to a surge in buyer demand. The heightened buyer demand happened while the supply of homes for sale was at record lows, and that imbalance put upward pressure on home prices. However, today’s higher mortgage rates have slowed down price appreciation.

And, the truth is, home price appreciation varies by market. Some areas are seeing slight declines while others have prices that are climbing. As Selma Hepp, Chief Economist at CoreLogic, explains:

“The divergence in home price changes across the U.S. reflects a tale of two housing markets. Declines in the West are due to the tech industry slowdown and a severe lack of affordability after decades of undersupply. The consistent gains in the Southeast and South reflect strong job markets, in-migration patterns and relative affordability due to new home construction.”

To find out what’s happening with prices in your local market, reach out to a trusted real estate agent.

The most positive factor in affordability right now is rising income. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have grown over time:

Higher wages improve affordability because they reduce the percentage of your income it takes to pay your mortgage since you don’t have to put as much of your paycheck toward your monthly housing cost.

Home affordability comes down to a combination of rates, prices, and wages. If you have questions or want to learn more, reach out to a real estate professional who can explain what’s happening locally and how these factors work together.

If you’re planning to buy a home, knowing the key factors that impact affordability is important so you can make an informed decision. To stay up to date on the latest on each, let’s connect today.

Buying

When buying a home, one of the biggest questions isn’t just whether you can pay cash – it’s whether you should. While paying cash can feel like the cleanest option, fi… Read more

Buying

If you’re planning to buy a home this year, you may be focused on the spring market.

Selling

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that's actually waiting too long to get started by… Read more

Real Estate Update

Whether you bought, sold, refinanced, or simply maintained your place this year, a tidy “home file” now saves hours – and dollars – when taxes hit in April. Here’s a p… Read more

Real Estate Update

If you’ve seen headlines about home prices dropping, it’s easy to wonder what that means for the value of your home too. Here’s what you really need to know. Even wit… Read more

Selling

You’ve got big plans for 2026. But what you do this year could be the difference between a smooth sale and a stressful one. If you’re thinking of selling next spring (… Read more

You’ve got questions and we can’t wait to answer them.